Every entrepreneur knows that fuelling growth often requires financial backing. For those over 50 years in business, navigating the business landscape can present unique challenges, and leveraging a business loan can be a game-changer. Let’s explore seven powerful ways to harness the potential of a business loan to propel your enterprise to new heights.

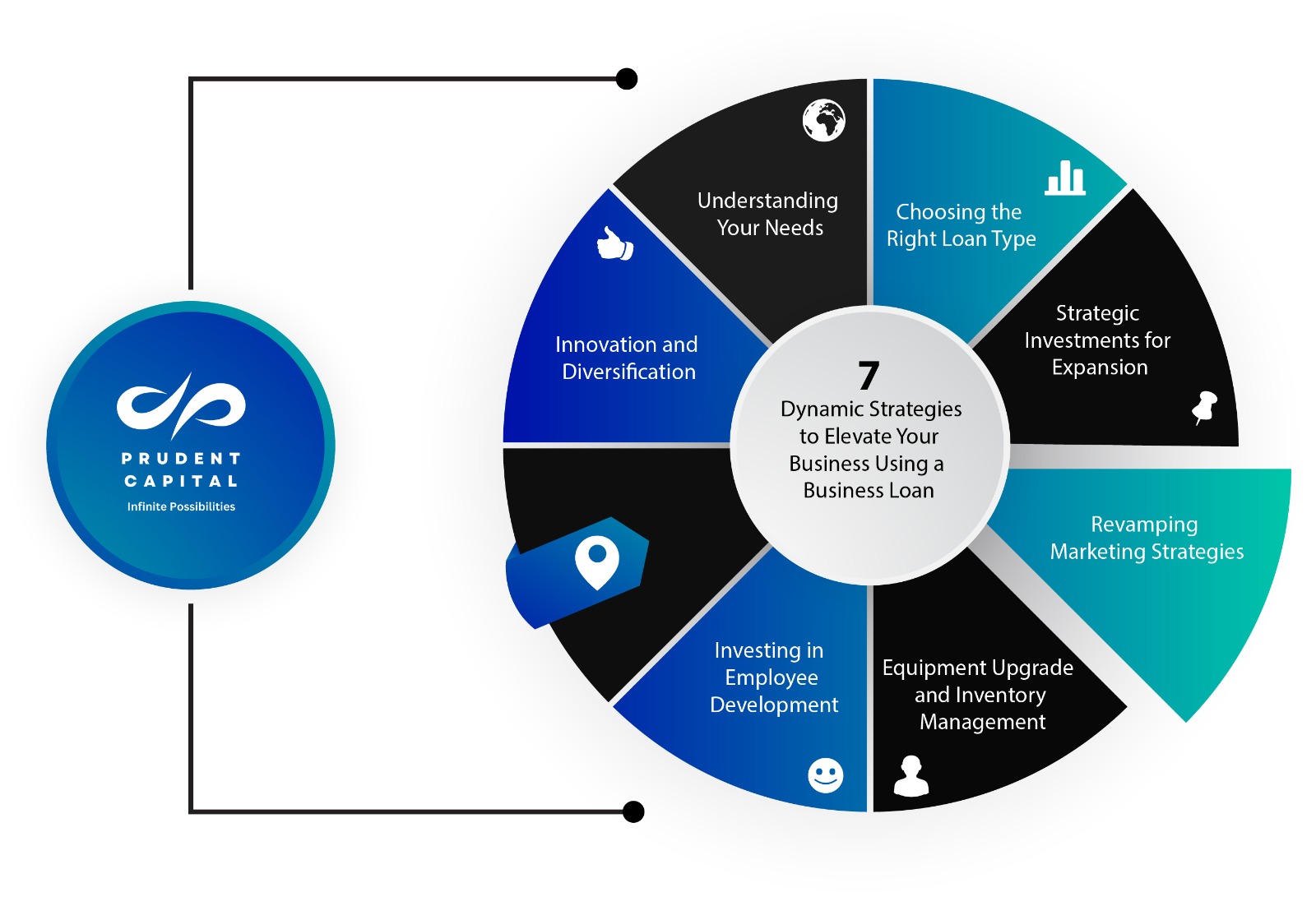

1. Understanding Your Needs

Before diving into the loan market, introspect! What does your business truly need? Whether expanding your market reach, upgrading equipment, or investing in marketing, identifying your specific requirements sets the stage for a focused loan application.

2. Choosing the Right Loan Type

With various loan options available, finding the one that aligns with your business goals is crucial. Consider the diverse range, from traditional term loans to lines of credit and SBA loans. Each type caters to different needs, so pick wisely to ensure it complements your objectives.

3. Strategic Investments for Expansion

Expanding your business footprint could be a game-changer. Whether opening new branches, entering untapped markets, or broadening services, a well-timed investment using the loan can significantly boost your clientele and revenue streams.

4. Revamping Marketing Strategies

Investing in marketing breathes life into your brand. Embrace digital marketing strategies tailored to your target demographic. A loan could fuel a robust online presence, driving more traffic and conversions. Remember, visibility translates into business growth.

5. Equipment Upgrade and Inventory Management

Efficient tools and well-managed inventory streamline operations. Upgrading equipment or adopting new technologies enhances productivity and quality. Moreover, managing inventory effectively with the help of a business loan ensures you meet increased demand without hiccups.

6. Investing in Employee Development

Your team is the backbone of your business. Empower them through skill development programs. Whether it’s training for new technologies or fostering leadership skills, a business loan invested in your workforce ultimately contributes to enhanced productivity and innovation.

7. Innovation and Diversification

Staying ahead in the market often requires innovation and diversification. Research and development initiatives, backed by a business loan, could lead to new product lines or service offerings. Embracing innovation ensures your business remains relevant and resilient in a constantly evolving landscape.

Embracing Financial Management for Success

While the prospect of a business loan is exciting, prudent financial management is key. Plan meticulously on utilising the loan amount and establish a clear repayment strategy. Seek advice from financial advisors to ensure sound financial decisions. Additionally, knowing the factors banks consider while approving business loans can be a lifesaver in navigating the loan approval process.

In conclusion, a business loan, when utilised strategically, can catalyze substantial business growth. Assess your business needs, explore loan options, and chart a roadmap for leveraging the loan effectively. Remember, it’s not just about the funds; it’s about the smart utilisation that sets your business on a trajectory towards success.

Understanding the Diverse Landscape of Business Loans

In entrepreneurship, securing financing is often crucial Fin fueling business growth and development. However, navigating the many business loan options available can take time and effort. Understanding the types of business loans and their unique advantages can be a game-changer for business owners seeking financial support. Let’s dive into the diverse landscape of business loans:

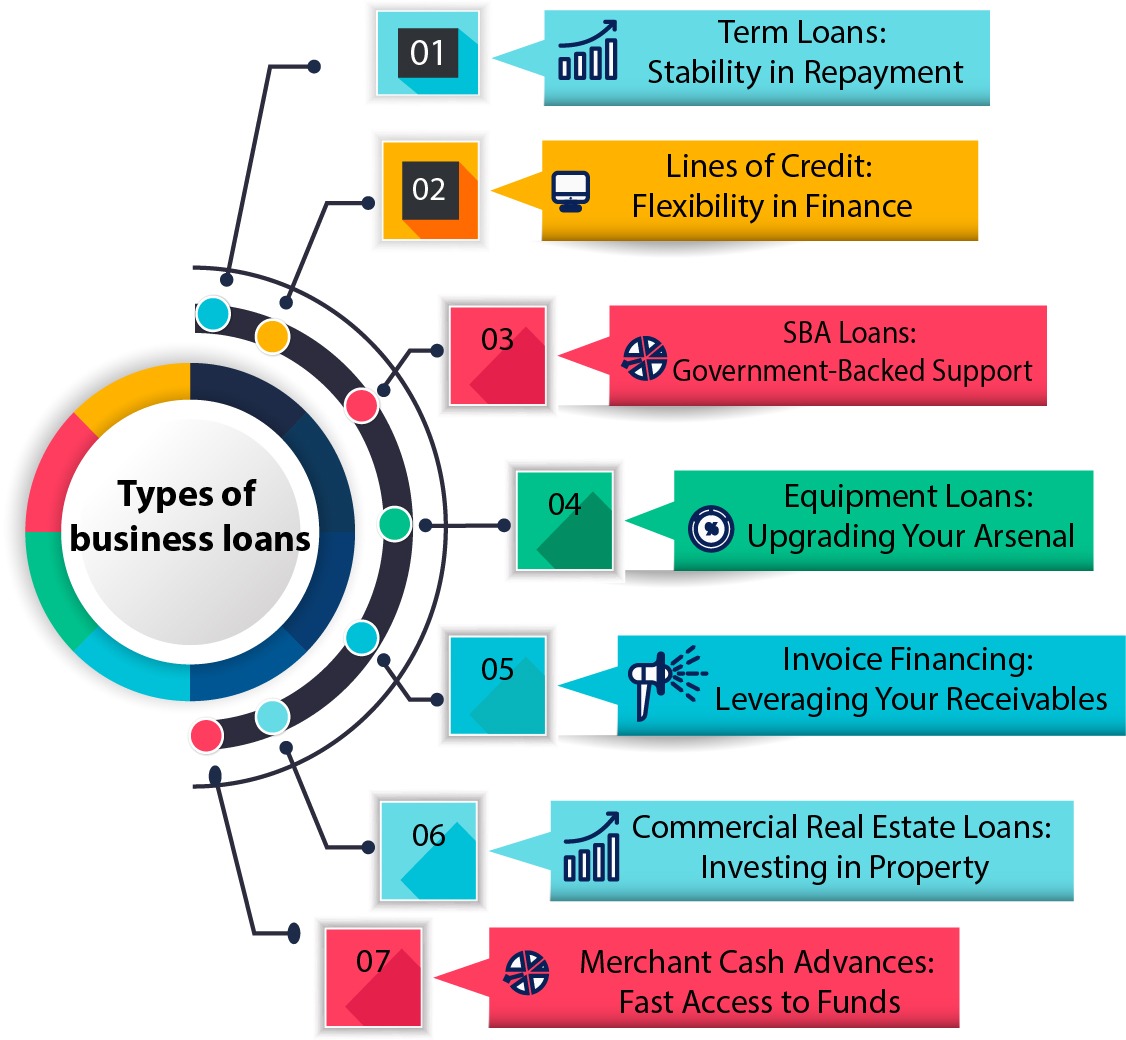

Types of Business Loans

1. Term Loans: Stability in Repayment

Term loans are the most sorted type of business loans among business owners. They involve borrowing a lump sum of money repaid over a predetermined period, usually with a fixed interest rate.

When to Consider: Ideal for substantial investments like equipment purchase, expansion, or hiring. They provide stability in repayment, making it easier to budget.

2. Lines of Credit: Flexibility in Finance

What They Are: A line of credit offers a flexible borrowing option where a lender approves a maximum credit limit. Businesses can withdraw funds as needed and pay interest only on the amount used.

When to Consider: Useful for managing cash flow fluctuations, covering short-term expenses, or taking advantage of unforeseen opportunities without committing to a lump sum loan.

3. SBA Loans: Government-Backed Support

What They Are: Small Business Administration (SBA) loans are partially guaranteed by the government, reducing the risk for lenders. They offer longer repayment terms and competitive rates.

When to Consider: Best suited for businesses with less access to traditional financing or those seeking longer-term loans with lower down payments.

4. Equipment Loans: Upgrading Your Arsenal

What They Are: These loans are designed to purchase equipment or machinery. The equipment itself serves as collateral, often leading to more favourable terms.

When to Consider: Equipment loans offer a specialised solution if you want to upgrade or replace equipment without impacting cash flow.

5. Invoice Financing: Leveraging Your Receivables

What It Is: Also known as accounts receivable financing, this option involves using unpaid invoices as collateral to secure a loan. Lenders advance a percentage of the invoice value and collect once customers pay.

When to Consider: If your business faces cash flow gaps due to slow-paying customers, invoice financing can provide immediate access to funds tied up in invoices.

6. Commercial Real Estate Loans: Investing in Property

What They Are: Tailored for purchasing or renovating commercial properties. These loans typically have longer terms and lower interest rates than commercial loans.

When to Consider: These loans offer property acquisition or development financing if you’re expanding your business space or investing in real estate.

7. Merchant Cash Advances: Fast Access to Funds

What They Are: A lump sum of cash provided upfront in exchange for a percentage of future credit card sales. Repayment is made through a percentage of daily sales.

When to Consider: If you require quick access to funds without a stringent credit check, merchant cash advances offer speedy financing.

Choosing Wisely for Business Success

Selecting the correct type of business loan requires a deep understanding of your business’s financial needs and goals. Each loan type comes with its own set of advantages and considerations. Evaluating the terms, interest rates, repayment options, and eligibility criteria is crucial before deciding.

Remember, while loans can provide essential financial support, responsible borrowing and sound financial planning are paramount. Assess your business’s requirements, explore options, and choose a loan that aligns with your long-term growth strategy.

In conclusion, the diversity in business loan offerings caters to the varied needs of entrepreneurs. By leveraging the correct type of loan at the right time, businesses can propel themselves towards success and sustainable growth.

FAQ

1.How should a business get a business loan from banks or NBFC?

Prudent Capital streamlines the process by leveraging our extensive network with major banks. We ensure a smooth application approval process, focusing on your unique business needs.

2.How should a startup business get a business loan from banks or NBFC?

Startups often face unique challenges, and we understand that. Our approach involves providing tailored solutions for startups, emphasising business plans, and assisting in establishing a solid foundation to boost loan approval.

3.What are the prevalent interest rates on business loans?

Each firm is unique and has a distinct goal. Prudent Capital is dedicated to obtaining competitive interest rates, although they may differ at times.Our tie-ups with major financial institutions enable us to negotiate favourable terms, ensuring your business thrives economically.

Add a Comment