Advantages and Disadvantages of Term Loans: What You Need to Know

These financial instruments have the potential to reshape growth trajectories and enhance financial stability for businesses. Imagine accessing a substantial injection of funds, complete with fixed interest rates for seamless financial planning and extended repayment periods for manageable cash flows. Term loans represent a gateway to financial empowerment, particularly advantageous for enterprises with strong credit scores.

In this detailed blog, we’ll take a close look at term loans. We’ll explore the advantages that can help your business, and we’ll also talk about the things you need to be careful about. Whether you’re someone experienced in business or just starting out, this guide will help you understand what term loans are all about.

What is a Term Loan? How does it work?

A term loan is a specific category of loan that involves repaying a predetermined sum of money over a specified period, usually spanning from 1 to 10 years. These loans are commonly utilized to finance substantial purchases, such as equipment or real estate.

The operational process of a term loan is notably straightforward, once you acquire a designated sum from a lender, you undertake the responsibility of reimbursing this loan over a predefined period. This repayment is typically facilitated through regular, consistent monthly installments.

What distinguishes term loans is their fixed interest rate, which ensures predictability by allowing you to determine the exact interest amount payable each month. In essence, a term loan encapsulates a clear arrangement where you borrow a specific amount and then adhere to a structured timeline for its repayment, ensuring a systematic and predictable approach to settling the debt.

Advantages of Term Loans

Term loans stand as a pillar of financial support for businesses, offering a range of advantages that can redefine growth and stability. Let’s dive into these benefits to gain a comprehensive understanding of how term loans can empower your business’s financial journey.

-

- Financial Flexibility and Stability

Term loans introduce a sense of stability and predictability to your financial obligations. With a fixed repayment structure, you can precisely determine your monthly payments, streamlining budgeting and cash flow management. This foresight extends to long-term planning, allowing you to harmonize business strategies with financial commitments. This dual sense of stability collectively fosters business growth and equilibrium.

- Financial Flexibility and Stability

-

- Lower Interest Rates

Term loans offer the advantage of cost-effective borrowing, particularly for loans backed by collateral. Collateralized loans, where you provide assets as security, often result in more favorable interest terms due to perceived lower risk for lenders. Furthermore, fixed interest rates serve as a safeguard against market rate volatility, simplifying financial projections and eliminating uncertainty about future borrowing costs.

- Lower Interest Rates

-

- Access to Larger Capital

Term loans serve as a gateway to substantial capital, rendering them ideal for ambitious undertakings. Whether your focus is expansion, embarking on significant ventures, or making substantial asset investments, term loans equip you with the financial means to seize opportunities that might otherwise remain elusive. This capacity to access larger capital positions your business to thrive on a more expansive scale.

- Access to Larger Capital

-

- Diversified Use

A core strength of term loans lies in their adaptability. Unlike financing options with imposed usage limitations, term loans empower you to allocate funds as per your specific business needs. Whether addressing challenges, pursuing avenues for growth, or enhancing operational capabilities, term loans deliver the financial versatility necessary to navigate dynamic market conditions.

- Diversified Use

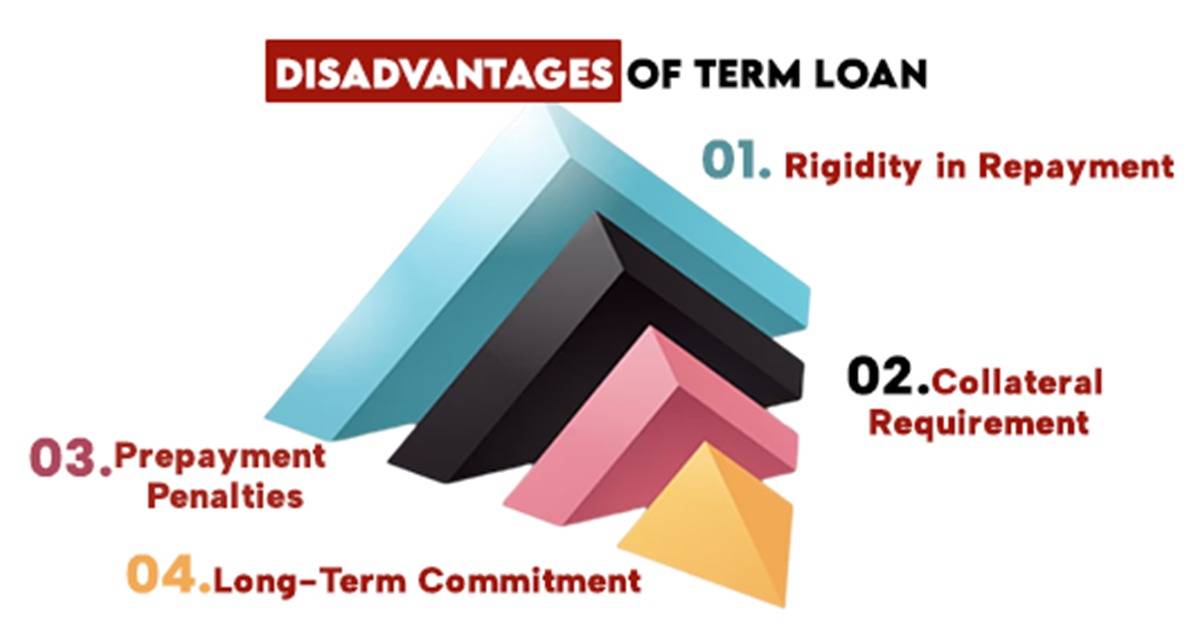

Disadvantages of Term Loan

As we explore the pros of term loans, it’s essential to recognize the potential challenges that can accompany these financing options. Here’s a closer look at these disadvantages, shedding light on the considerations that businesses should be mindful of:

A. Rigidity in Repayment

The structured nature of term loan repayments, while aiding in financial planning, can also introduce rigidity. This fixed repayment schedule might become a challenge if unexpected financial fluctuations occur, as adapting repayment schedules accordingly might not be feasible. Furthermore, the consistency of fixed monthly payments can strain cash flow, particularly during periods of financial tightness. This rigidity necessitates careful budgeting to ensure consistent meeting of financial obligations.

B. Collateral Requirement

Term loans often require collateral, which can present potential disadvantages. While collateralization can secure lower interest rates, the risk lies in the possibility of asset seizure in case of loan default. Pledging valuable assets as collateral can also impact your business’s asset portfolio, potentially limiting its usability for other financial opportunities.

C. Prepayment Penalties

Term loans might come with prepayment penalties if you choose to pay off the loan ahead of schedule. While intended to ensure lenders earn expected interest, these penalties can complicate early loan repayment. Weighing potential cost savings on interest against prepayment penalties becomes a crucial factor when considering paying off the loan before its term.

D. Long-Term Commitment

Opting for a term loan commits your business to a long-term financial arrangement. While this might suit certain needs, it can potentially impact business flexibility. Tied-up cash flow and financial capacity might hinder your ability to swiftly respond to unforeseen opportunities or challenges. Moreover, committing to a long-term loan might not align with potential shifts in your business’s strategic direction.

In essence, while term loans offer various advantages, understanding these potential disadvantages is equally vital. This comprehensive perspective empowers businesses to make informed financial decisions that align with their unique circumstances and aspirations.

Summary

Term loans stand as a dual-edged sword, offering a robust array of advantages that can propel your business to new heights, while also presenting potential challenges that require careful consideration. As you traverse the landscape of financing options, arming yourself with knowledge about the pros and cons of term loans is a strategic move.

Ultimately, the journey of business financing is about achieving an equilibrium between aspiration and caution. Term loans, when embraced with prudence and foresight, can be a pivotal driver in propelling your business toward its goals, fortifying financial health, and ensuring a dynamic and sustainable future.j