In today’s dynamic business environment, access to capital without the need for security can be a game-changer for entrepreneurs. Prudent Capital understands this need and offers loan for businesses without security, providing a pathway to growth without the burden of collateral. Explore the features, benefits, eligibility criteria, application process, tenure, repayment modes, and discover why Prudent Capital is the trusted partner for entrepreneurs seeking hassle-free funding solutions.

Key Features of Business loan without security

- Loan Amount Range: ₹5 lakh to ₹10 Crore.

- Competitive Interest Rates: Starting from 18% per annum.

- Transparent Pricing: No hidden fees or charges.

- Flexible Repayment Tenure: Up to 60 months.

- Personalized Assistance: Dedicated support throughout the loan process.

Benefits

- Financial Flexibility: Access funds without the need for collateral, enabling strategic business decisions.

- Affordable Terms: Competitive interest rates minimize the cost of capital, maximizing profitability.

- Longer Repayment Tenure: Spread out repayment burden over a comfortable timeframe, managing cash flow effectively.

- Tailored Solutions: Customize loan terms to align with specific business objectives and financial capabilities.

Eligibility Criteria to get loan for business without security

- Minimum Age: 21 years.

- Business Vintage: 1 to 3 years.

- Credit Score: Minimum 700.

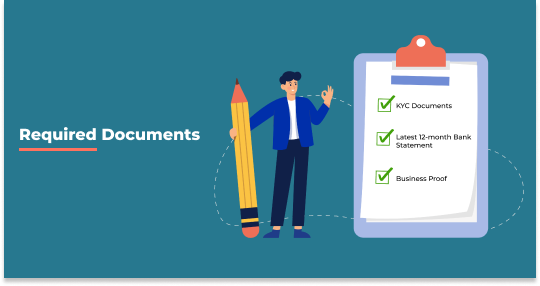

Required Documents

1. KYC Documents.

2. Latest 12-month Bank Statement.

3. Business Proof.

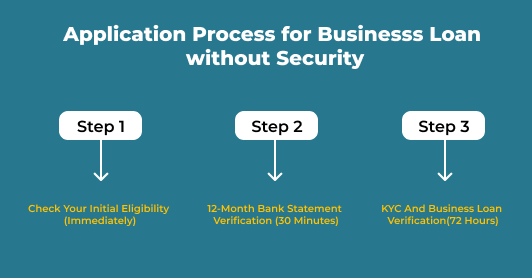

How to apply for a business loan without security?

1. Fill out the loan application form.

2. Provide basic information about yourself and your business.

3. Submit required documents.

4. Undergo verification process.

5. Receive notification of loan approval status.

Loan Tenure or Duration for Business Loan Without Security

The loan tenure for business loans without security varies based on borrower preferences and lender policies. Prudent Capital offers customizable tenure options tailored to the borrower’s needs, ensuring manageable repayment schedules aligned with business cash flows.

Loan Tenure: Customizable options based on borrower preferences. Ensure repayment schedules align with business cash flows.

Mode of Repayment

Repayment modes for business loans without security include monthly installments via post-dated cheques, electronic clearing service (ECS), or auto-debit facility, providing convenience and ensuring timely payments.

Why choose Prudent Capital?

Prudent Capital emerges as the preferred choice for business loans without security due to expertise, quick approval processes, flexible terms, and a customer-centric approach. Benefit from personalized assistance, competitive interest rates, and transparent dealings to fuel your business growth.

Difference between Secured Loans vs. Unsecured Loans

Secured loans require collateral, while unsecured loans like those offered by Prudent Capital do not necessitate security. Enjoy the flexibility and financial freedom of unsecured business loans without the burden of pledging assets.

Key Difference:

Secured Loans: Require collateral.

Unsecured Loans: Do not require security.

In conclusion, Prudent Capital’s business loans without security provide entrepreneurs with a viable funding solution, enabling them to pursue their business goals with confidence. With transparent processes, competitive terms, and personalized support, entrepreneurs can unlock growth opportunities and propel their businesses forward. Apply today and experience financial flexibility with Prudent Capital.

FAQ

1.How to get a loan without security?

To secure a loan without collateral, you typically need a strong credit history, stable income, and a good relationship with the lender. Banks and financial institutions offer unsecured loans based on your creditworthiness and ability to repay. Start by checking your credit score and comparing loan options from various lenders. Prepare to provide proof of income and other funding documents to support your application.

- Can a bank give a loan without security?

Yes, banks can offer loans without requiring collateral, known as unsecured loans. However, approval for such loans depends on factors like your credit history, income stability, and debt-to-income ratio. Banks assess the borrower’s creditworthiness to determine the risk of lending without security. While unsecured loans may have higher interest rates compared to secured loans, they provide a financing option for individuals who may not have assets to pledge as collateral. It’s advisable to inquire directly with your bank about their specific unsecured loan offerings and eligibility criteria.