Are there business loans for doctors at low interest and without collateral? How to get these business loans for your medical practice? Is it easy to apply? What are the interest rates?

The questions in the minds of every doctor, medical practitioner or hospitals are unending. Prudent Capital has a very high percentage of success ratio in getting healthcare professionals the funding and business loans required for them in a short span of time. Healthcare professional loans for doctors to pursue their entrepreneurial journey is quite important and once they scale a Medical Equipment loan becomes inevitable.

From setting up a private practice to upgrading medical equipment, the financial needs of doctors are diverse and dynamic. At Prudent Capital, we are proud to be considered the best lender consultants for medical practice loans with a high success ratio. In this article, we will explore funding options for healthcare businesses, shedding light on the documents required, eligibility criteria, application process, and more.

No collateral Business Loans for doctors

Business loans for doctors are tailored financial products designed to meet the distinctive funding needs of medical professionals. These loans play a pivotal role in supporting a myriad of requirements, ranging from establishing new clinics to expanding existing practices. Just like any other entrepreneurs, doctors often find themselves in need of capital to grow and enhance their professional ventures. Business loans become a crucial source of financial support, enabling doctors to achieve their goals without compromising the quality of healthcare services they provide. This unique financial tool empowers doctors to navigate the challenges of the medical field, fostering growth and sustainability in their practices.

Eligibility Criteria

A. Professional Qualifications

To qualify for a business loan, doctors typically need to have relevant professional qualifications and certifications. Lenders may assess the doctor’s specialisation and expertise to gauge the viability of the loan.

B. Years of Practice

The number of years a doctor has been in practice is a crucial factor. Lenders may prefer doctors with a proven track record, demonstrating stability and reliability in their profession.

C. Financial Stability

Lenders often evaluate the financial stability of doctors before approving a loan. This includes assessing income, liabilities, and the overall financial health of the medical practice.

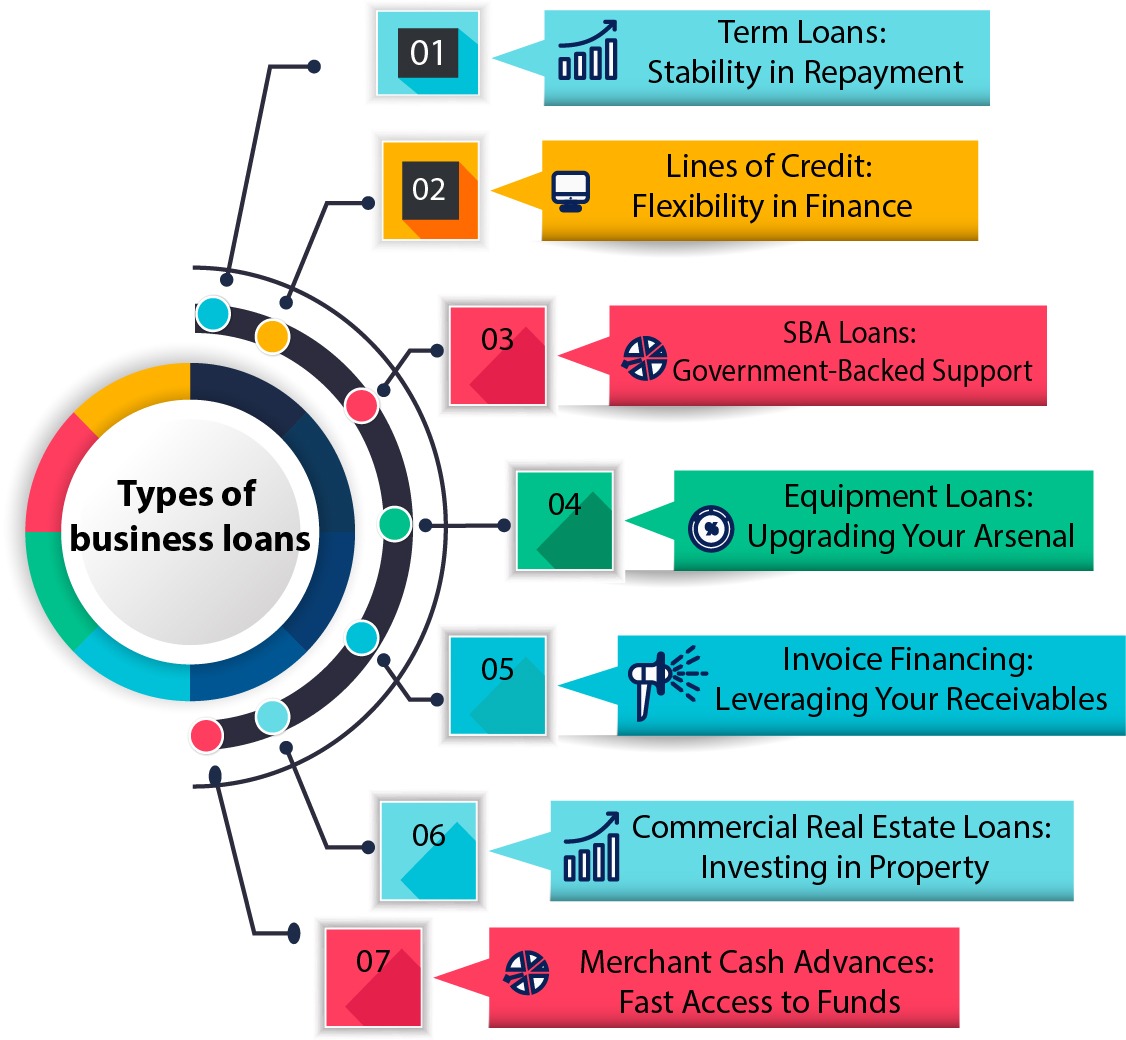

Types of Business Loans for Doctors

A. Secured Loans

Secured loans necessitate the provision of collateral, which could include assets like real estate or specific pieces of equipment. These are loans given with a gurantor in place or loans against property. They often come with lower interest rates, making them a viable option for doctors with valuable assets.

B. Unsecured Loans

Loans without collateral, known as unsecured loans, don’t necessitate the pledging of assets; however, they may come with elevated interest rates. They are suitable for doctors who may not have substantial assets to pledge.

C. Medical Equipment loans

Medical Equipment Loans are specifically designed for acquiring medical equipment, this type of loan allows doctors to stay technologically updated, enhancing the quality of patient care.

D. Working Capital Loans

Working capital loans provide doctors with the necessary funds to cover day-to-day operational expenses, ensuring smooth business operations.

Documents Required for Doctor’s Loan

1. Personal Identification Documents

Lenders typically request documents such as a valid ID, passport, or driver’s licence to verify the identity of the doctor applying for the loan.

2. Professional Certificates

Proof of professional qualifications and certifications is crucial for demonstrating the doctor’s expertise and eligibility for the loan.

3. Financial Statements

Financial statements, including income statements and balance sheets, offer insights into the doctor’s financial stability and repayment capacity.

4. Business Plan

A well-structured business plan outlines the purpose of the loan, the expected return on investment, and a repayment strategy, providing lenders with a clear understanding of the proposed venture.

Meeting all these document requirements ensures quick approval for medical business loans.

How to qualify for medical practice funding

A. Choosing the Right Lender

Selecting a suitable lender is a critical step in the application process. Doctors should research and compare lenders based on interest rates, repayment terms, and customer reviews.

B. Preparing a Strong Application

Crafting a comprehensive and well-documented loan application increases the chances of approval. Highlighting the purpose of the loan and the potential benefits to the medical practice is essential.

C. Timelines and Approval Process

Understanding the timelines and approval process helps doctors manage expectations and ensures a smoother loan acquisition process.

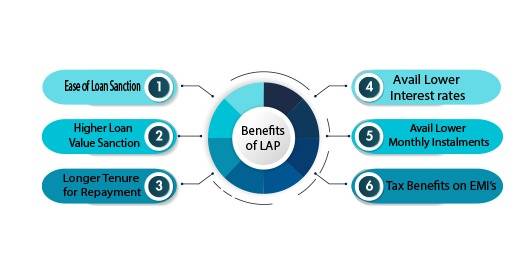

Interest Rates and Repayment Terms

Understanding Interest Rates

Doctors should familiarise themselves with the different types of interest rates offered by lenders, such as fixed and variable rates, to make informed decisions. Additionally, it’s crucial to compare interest rates for doctor business loans when making financial decisions.

Flexible Repayment Options

Lenders often provide various repayment options. Doctors should choose a plan that aligns with their cash flow and financial goals.

Impact of Credit Score

Maintaining a good credit score enhances the doctor’s credibility and increases the likelihood of securing favourable interest rates.

Advantages of Business Loans for Doctors

A. Expansion Opportunities

Business loans empower doctors to expand their medical practices, reach more patients, and explore new avenues for growth.

B. Upgrading Medical Equipment

Staying abreast of technological advancements in the medical field becomes feasible with business loans, allowing doctors to provide cutting-edge healthcare services.

C. Managing Cash Flow

Business loans assist doctors in managing cash flow efficiently, ensuring that operational expenses are met without delays.

Risks and Precautions

A. Financial Liabilities

Doctors should carefully assess their financial capabilities and only borrow what they can comfortably repay to avoid unnecessary financial strain.

B. Market Volatility

Being aware of market conditions and potential fluctuations helps doctors anticipate challenges and navigate uncertainties effectively.

C. Legal Implications

Understanding the legal aspects of the loan agreement is crucial to avoid any legal complications in the future.

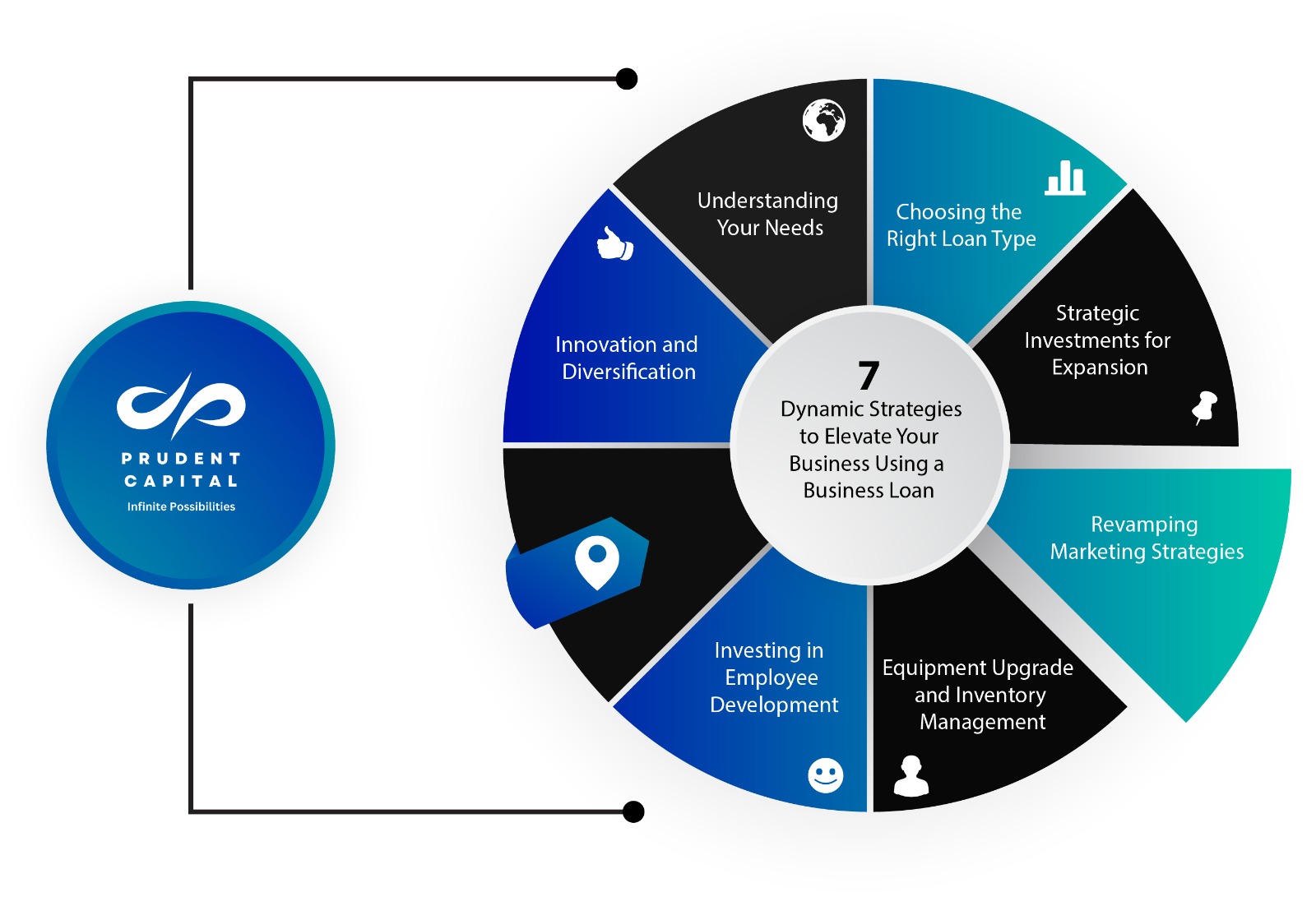

In summary, the significance of business loans for doctors cannot be overstated, as they serve as indispensable tools for fostering the growth and long-term sustainability of medical practices. These financial instruments empower medical professionals to pursue their career aspirations while upholding the highest standards of patient care. For physicians contemplating expansion, upgrading equipment, or enhancing cash flow, delving into the diverse array of business loans tailored to their specific needs represents a proactive stride towards establishing a thriving medical practice.

Should you believe that securing a professional loan can elevate your career and contribute to the expansion of your practice, Prudent Capital stands ready to assist. We provide accessible business loans with competitive interest rates and flexible EMI options. Get funding for your medical practice today!

FAQ

1.Are there tax benefits associated with business loans for doctors?

Yes, some business loans for doctors may offer tax benefits. It’s advisable to consult with a financial advisor like Prudent Capital for personalised guidance.

2.Can self-employed doctors also apply for business loans?

Yes, self-employed doctors can apply for business loans, provided they meet the eligibility criteria and submit the required documents.

3.Are Homeopathy or Ayurvedic practitioners eligible to apply for business loans?

Prudent Capital extends business loans to Homoeopathic and Ayurvedic doctors, provided they meet the specified eligibility criteria.