6 Benefits of Loan Against Property you need to know

A loan seeker needs to know the features and benefits of the loan type they are looking to avail so that they can compare the advantages against other available loans.

Taking a secured loan against property is far more beneficial when compared to unsecured loans like personal loans, term loans and loan against credit cards. There are many types of secured loans however we are going to gain knowledge on Loan Against Property.

The loan seeker can mortgage a clear title property self-owned or jointly owned commercial or residential to avail a loan against that property. The bank extends a loan equivalent to the property value at the time of mortgage.

Why should a loan seeker opt for a Loan against property?

Are there any special benefits to the loan seeker when LAP is availed?

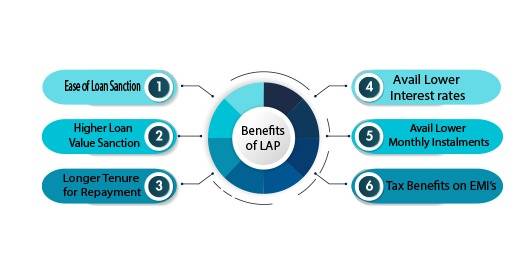

We have listed the top 6 benefits of LAP – Loan against property

- Ease of Loan Sanction

- Higher Loan Value Sanctioned

- Longer Tenure for Repayment

- Avail Lower Interest rates

- Avail Lower Monthly Instalments

- Tax Benefits on EMI’s

- Ease of Loan Sanction

Banks and NBFC’s are highly motivated and enthusiastic when it comes to offering loans against property. Loans against property actually puts the lenders in a safe position in fact it also safe guards the borrower. If all paperwork is in place and accurate the banks and NBFC’s will sanction the loans quite easily and quickly.

- Higher Loan Value Sanctioned

Loan seeker need to plan their loan journey and, in this way, they can plan the entire tenure and stick to the plan which helps them to repay without any hassle and also plan closure quite comfortably. Banks are quite happy a high value loan based on the property value so that they loan can satisfy few objectives and requirements.

- Longer Tenure for Repayment

For Loan Against Property that falls under the secured loan category, the banks willingly offer longer repayment tenures. The maximum repayment tenure with nationalized banks and top banks is 15 years however in some special cases it can be extended up to 20 years and that is left to discretion of the authorities of the banks and NBFC’s.

- Avail Lower Interest rates

Lending institutions are willing to offer the advantage of lower interest rates to the loan against property borrowers. The banks in most cases offer a variable low interest rates and in some rare cases they offer fixed interest rates.

- Avail Lower Monthly Instalments

Banks and NBFC’s always try to increase offering secured loans as against to unsecured loans. It positions both the banks and the consumer on a safe loan transaction. The lenders woo their consumers by offering higher repayment terms, lower interest rates and lower monthly instalments.

- Tax Benefits on EMI’s

Under the secured loan category for certain loan product types there are reductions in tax on the monthly EMI’s. There are two types of people involved in getting this done, the lender and the tax consultant of the borrower. Under certain clauses the banks will be able to offer a tax rebate. It is recommended that the lender checks with their tax consultant before hand on this clause.

It is quite important that the lender plans before going ahead with a loan. Financial discipline is vital when it comes to using the loan acquired. Have a clear vision for what you need the loan, what type of loan and the advantages available in that loan that could be used towards your benefit. Try to make use of all the features and benefits of a loan against property so that you can save money and time.

FAQ’s

- How many days will it take to get a LAP Sanctioned?

LAPs are sanctioned based on the property submitted. The property must be with clear title and accurate paper work. If all documents are in place one can get a LAP sanctioned in a week or two.

- Are there differences in LAP based on Property location?

Yes, LAP – Loan against property can differ based on the location of the property. If a property is in a Prime Location of the city, then the value of the property can be much higher than a property in the outskirts. Based on the value of the property there can be differences in LAP.

- Do banks accept un-registered properties for LAP?

As the name goes it is a Secured Loan and banks or NBFC’s don’t accept un-registered properties to offer loan against property. Banks can reject the loan application based on illegal documentation, litigation documentation and properties in disputes. So, when applying for a LAP please ensure that the property papers have a clear title.

Add a Comment