MSME Loan Without Collateral- Empowering Businesses with Prudent Capital

In the world of small and medium enterprises (SMEs), access to capital is often a crucial determinant of success. However, traditional lending practices often require entrepreneurs to provide collateral, which can be a significant barrier for those with limited assets or resources. In response to this challenge, collateral-free MSME loans emerge as a beacon of hope, offering a pathway for entrepreneurs to access the funding they need without the burden of pledging assets.

These loans signify not just monetary support but embody empowerment. By removing the requirement for collateral, MSME loans enable entrepreneurs to pursue their business dreams with confidence and conviction. They level the playing field, allowing businesses of all sizes and backgrounds to compete on merit rather than financial standing.

Moreover, collateral-free business loans foster a culture of innovation and entrepreneurship. By providing accessible funding solutions, they encourage risk-taking and experimentation, driving economic growth and job creation. Entrepreneurs are empowered to explore new markets, invest in technology and infrastructure, and expand their operations without fear of losing their hard-earned assets.

At the heart of the collateral-free MSME loan is the idea of empowerment. It’s about giving entrepreneurs the tools they need to succeed and thrive in an increasingly competitive business landscape. With the support of lenders like Prudent Capital, entrepreneurs can seize opportunities, overcome challenges, and realize their full potential, driving not only their own success but also the prosperity of their communities and economies.

What are the Benefits of an MSME Loan Without Collateral?

MSME (Micro, Small, and Medium Enterprises) loans without collateral offer numerous advantages for entrepreneurs and businesses:

Accessibility: Collateral-free MSME loans provide access to funding for businesses that may not have valuable assets to pledge as security. This accessibility enables a broader range of entrepreneurs to obtain financing for their ventures.

Flexibility: Without the requirement of collateral, businesses have more flexibility in how they utilize the funds. Whether it’s for expansion, working capital, equipment purchase, or other operational needs, entrepreneurs can allocate the funds according to their specific requirements.

Speedy Processing: The absence of collateral simplifies the loan approval process, leading to quicker decision-making and fund disbursement. This speed can be crucial for businesses facing time-sensitive opportunities or challenges.

Risk Mitigation: Since collateral-free loans do not involve the risk of asset seizure in case of default, entrepreneurs can protect their valuable assets and focus on business operations without the fear of losing collateral.

Promotes Growth: By providing access to capital without the need for collateral, MSME loans facilitate business growth and expansion. Entrepreneurs can invest in innovation, expand their market reach, upgrade technology, hire additional staff, and pursue new opportunities to drive overall business development.

Encourages Entrepreneurship: Collateral-free MSME loans encourage entrepreneurship by lowering the barriers to entry for aspiring business owners. This support fosters a culture of innovation and economic growth, as more individuals are empowered to start and grow their own businesses.

To secure an MSME loan without collateral

Entrepreneurs must meet certain eligibility criteria and provide essential documents. Here’s a detailed guide of how to get MSME loan without collateral:

Eligibility Criteria

1.Age Requirement: Applicants need to be a minimum of 21 years old.

2. Business Vintage: The business should have a vintage of 1 to 3 years.

3. Credit Score: A minimum credit score of 700 is required to assess the applicant’s creditworthiness.

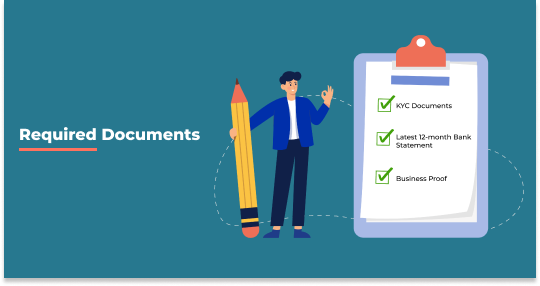

Documents Required

1. KYC (Know Your Customer):

Valid identification documents such as Aadhar card, passport, driver’s license, or PAN card to verify identity and personal details.

2. Latest 12-Month Bank Statement:

The business’s latest 12-month bank statement to assess financial health, cash flow patterns, and repayment capacity. This helps in understanding the business’s revenue streams and financial stability.

3. Business Proof:

Valid documents proving the existence and legitimacy of the business, including GST registration certificate, business registration documents, partnership deed, or any other relevant legal documentation.

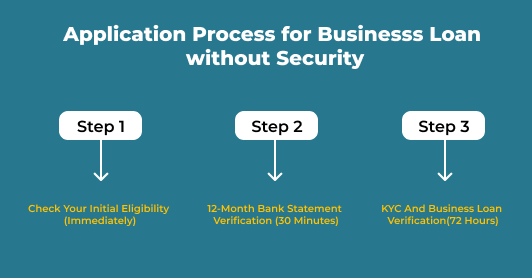

Application Process

1. Initial Eligibility Check:

Fill out the loan application form with basic information about yourself and your business to determine initial eligibility instantly.

Provide essential details about your business, including turnover, industry sector, and business model.

2. 12-Month Bank Statement Verification:

Submit your 12-month bank statement for verification.

Prudent Capital assesses your financial history and stability, typically completing this process within 30 minutes.

3. KYC and Business Loan Verification:

Complete a basic KYC process by supplying pertinent identity documents.

Additional business-related information may be required for a final review and verification of the loan request.

The verification process may take up to 72 hours, after which you’ll receive prompt notification of your loan approval status upon successful verification.

By providing these essential documents and completing the application process, entrepreneurs can expedite the loan approval process and access the funding needed to fuel their business growth.At Prudent Capital, we emphasize operational efficiency and transparency, guaranteeing a smooth journey for our borrowers.Partner with Prudent Capital today and take the next step towards realizing your business goals.

MSME Loan without Collateral

The MSME loan limit without collateral varies depending on several factors, including the financial institution offering the loan, the borrower’s creditworthiness, business performance, and repayment capacity.Nevertheless, here’s a broad outline of what you can anticipate:

1. Loan Amount: Collateral-free MSME loans typically range from a few lakhs to several crores, catering to the diverse funding requirements of small and medium enterprises.

2. Creditworthiness: Lenders assess the borrower’s creditworthiness based on factors such as credit score, business vintage, turnover, profitability, and repayment history. A strong credit profile may qualify the borrower for a higher loan amount.

3. Business Performance: The financial health and performance of the business also play a crucial role in determining the loan limit. Lenders may consider factors such as revenue, profitability, cash flow, and stability when evaluating the loan application.

4. Repayment Capacity: Lenders assess the borrower’s repayment capacity to ensure that the loan amount is manageable and sustainable. This involves analyzing the business’s ability to generate sufficient cash flow to meet loan obligations.

5. Industry Sector: The loan limit may also vary based on the industry sector in which the business operates. Some sectors may have higher perceived risks, leading to lower loan limits or stricter eligibility criteria.

Overall, while collateral-free MSME loans offer flexibility and accessibility, the loan limit is determined based on various factors to mitigate risks for both the lender and the borrower. Entrepreneurs are encouraged to discuss their funding requirements with lenders to understand the loan options available and determine the most suitable financing solution for their business needs.

FAQ

1. Can I get an MSME loan without collateral?

Yes, Prudent Capital offers collateral-free MSME loans tailored to meet the funding needs of entrepreneurs. These loans provide accessible financing solutions without requiring collateral, enabling businesses to access funds for growth and expansion.

2. What is the interest rate for MSME collateral-free loans?

The interest rate for collateral-free MSME loans may vary depending on various factors such as the loan amount, tenure, creditworthiness of the borrower, and prevailing market conditions. Prudent Capital offers competitive interest rates tailored to suit the financial needs of MSMEs.

3. Is an MSME loan secured or unsecured?

MSME loans offered by Prudent Capital without collateral are unsecured loans. This means that borrowers are not required to pledge any collateral or security against the loan amount. These loans are based on the creditworthiness and repayment capacity of the borrower, providing accessibility and flexibility in funding solutions.

4. Can I get a 5 crore loan without collateral?

Yes, it is possible to obtain a 5 crore loan without collateral from Prudent Capital, provided that the borrower meets the eligibility criteria and demonstrates a strong credit profile, business vintage, and repayment capacity. Prudent Capital offers flexible loan limits tailored to the specific needs of MSMEs, enabling businesses to access substantial funding for expansion, working capital, or other business requirements without the need for collateral.