In the dynamic landscape of business, the wheels of progress are often powered by a critical force namely business loans. Regardless of size, businesses rely on these financial lifelines to fuel their growth engines. Picture them as keys that unlock a realm of possibilities, allowing businesses to secure their present and invest in their future.

Consider the diverse scenarios: a corner store replenishing its shelves, a factory upgrading its machinery, or an ambitious startup expanding its reach. Business loans are the heroes, stepping in to provide the necessary funds.

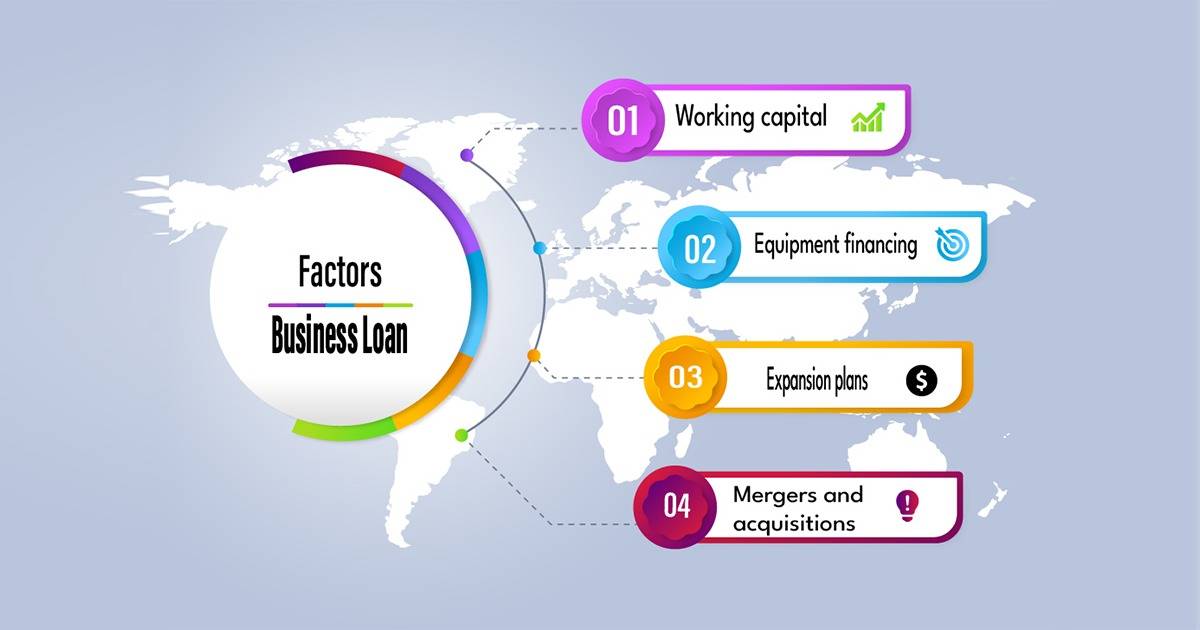

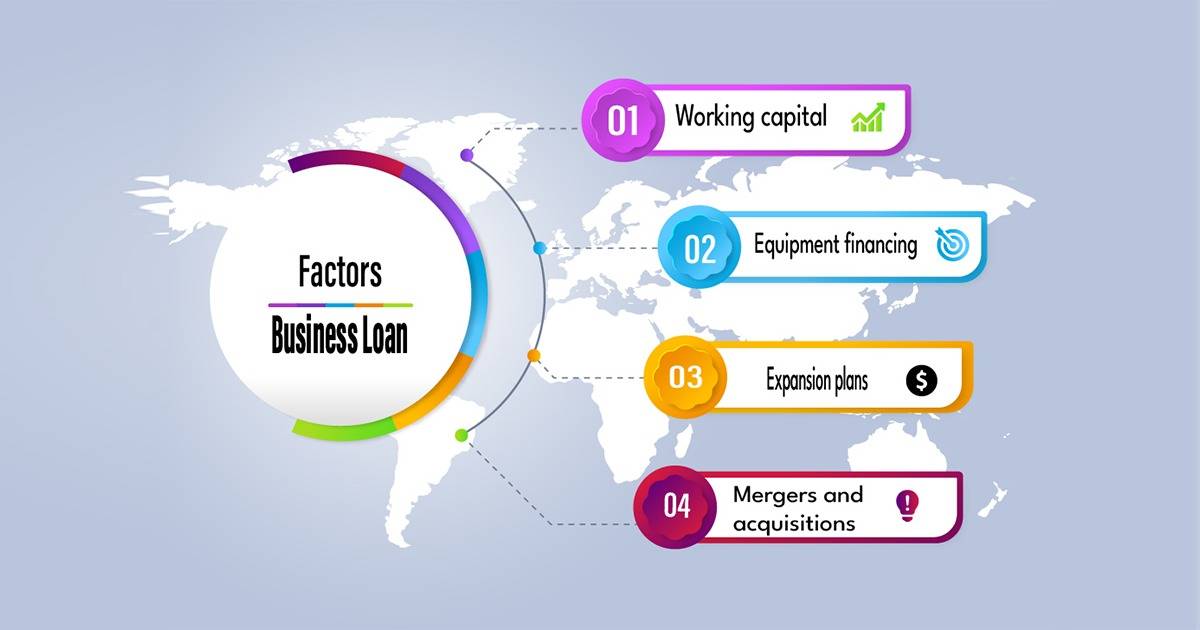

These loans fulfill a diverse range of roles:

-

- Working capital: Funds for day-to-day activities such as payroll, inventory, and expenses.

-

- Equipment financing: Enabling equipment upgrades, from machinery to vehicles.

-

- Expansion plans: Facilitating growth through hiring, launching new products, or opening new locations.

-

- Mergers and acquisitions: Supporting strategic expansion through business acquisitions.

What Banks Look for When Reviewing Your Business Loan Application?

If you’re thinking about getting a bank loan for your business, it’s a good idea to know what things the bank looks at before they decide to approve your loan. This way, you can be prepared and make the process smoother.Credit Worthiness

The numerical value, a credit rating, is a key indicator of the borrower’s creditworthiness. It’s essentially a snapshot of how responsible the borrower has been with their past credit activities. The credit score is determined by analyzing various aspects of the borrower’s credit history, such as their track record of making timely payments, the extent of their outstanding debt, and the duration of their credit history. A higher credit score typically suggests that the borrower has effectively managed their finances, which boosts their credibility in the eyes of lenders. While credit score requirements can differ based on the type of loan and the lending institution, a generally accepted benchmark for a good credit score is 680 or higher. By focusing on building and maintaining a healthy credit profile, businesses can increase their chances of obtaining the funding needed to propel their growth and aspirations.Financial History Evaluation

The financial history of your business constitutes a comprehensive record of its financial performance and activities over an extended duration. This repository encompasses vital documents such as balance sheets, income statements, and cash flow statements, collectively offering a profound insight into your financial landscape. As an integral aspect of the loan application assessment process, financial institutions meticulously review this historical data to glean an understanding of your past financial conduct. When lenders review your financial records, they look at things like your revenue, expenses, assets, and liabilities. This helps them understand how well you manage your money and how likely you are to repay the loan. If your financial records are accurate and organized, it will make it easier for the lender to make a decision about your loan application.Business Plan Scrutiny

In the process of reviewing business loan requests, financial institutions thoroughly examine the submitted business plan. This assessment involves three key aspects-

- Step 1: They carefully analyze the components of a robust business plan, ensuring it covers clear goals, your target audience, what you’re offering, and viable strategies.

-

- Step 2: Banks evaluate your understanding of the market and competition, studying your research on industry trends, competitors, and possible challenges.

-

- Step 3: Banks gauge the financial projections and practicality of your plan, assessing expected income, expenses, and profits.

Add a Comment