What is Working Capital? Its Importance, Formula, and Components

In the intricate landscape of business finance, a term emerges as a steadfast conductor i.e., working capital. Often dubbed as the “lifeblood” of enterprises, working capital quietly ensures bills are paid, gears keep turning, and growth is sustained. Yet, its impact extends beyond balance sheets, working capital embodies a company’s resilience and its prowess in seizing fleeting opportunities.

Our blog stands as your reliable companion through the realm of working capital, unveiling its intricacies and emphasizing its significance. Whether you’re a seasoned industry expert or a newcomer to entrepreneurship, this handbook equips you with the insights necessary to navigate the currents of working capital and steer your business toward triumph. Join us as we embark on this journey to demystify working capital’s role and unleash its strategic potential.

Understanding Working Capital

Working capital is a financial term that’s like the money a business keeps in its wallet for everyday expenses. Imagine you have some cash and owe a little money to a friend. The difference between the cash you have and the money you owe is your working capital. It’s essential for businesses because it helps them pay their bills on time, buy things to sell, and even try new ideas to grow.

Just like having some extra money in your pocket for unexpected needs, having enough working capital gives businesses a safety net. But if a business doesn’t have enough, it might struggle to pay its bills or have trouble trying new things. In a nutshell, working capital is the financial fuel that keeps businesses going, growing, and ready for whatever comes their way.

Crucial Role of Working Capital in Business Operations

Working capital isn’t just a financial metric; it’s a linchpin that keeps business gears turning. Here’s why:

Short-Term Obligations: Working capital ensures the company can meet payroll, rent, and other imminent obligations, fostering stability.

Inventory Management: With working capital, businesses secure resources to purchase inventory, ensuring a steady flow of products for customers.

Innovation and Growth: It fuels innovation by financing new products or services, propelling business expansion and market reach.

Resilience: Unexpected expenses, from natural disasters to legal disputes, are cushioned by a robust working capital balance.

How to Calculate Working Capital?

Calculating working capital involves a straightforward process that requires gathering data on a company’s current assets and current liabilities.

Formula to calculate Working Capital

The formula to calculate working capital is straightforward and involves subtracting current liabilities from current assets:

Working Capital = Current Assets – Current Liabilities

Components of Working Capital

In the world of business finances, think of current assets and current liabilities as the building blocks of something important called working capital. This is like a special tool that shows how stable a company is in the short term and how much it can grow.

Current Assets: Fueling Business Operations

Think of current assets as a valuable collection that a company can use right away. These resources can be easily changed into money within a year. They’re like a safety net that helps a company pay its bills on time and handle the ups and downs of its business. The most common types of current assets include,

-

- Cash: The ultimate liquid asset, cash allows businesses to pay expenses and seize opportunities without delay.

-

- Accounts Receivable: Representing money owed by customers, accounts receivable highlight potential revenue yet to be collected.

-

- Inventory: Goods purchased but not yet sold, inventory is the merchandise ready to meet customer demands.

-

- Prepaid Expenses: Expenses paid in advance, such as rent or insurance, anticipate future costs.

Current Liabilities: Commitments on the Horizon

On the flip side, current liabilities encompass debts that a business must repay within a year. These are the obligations a company holds towards creditors. Essential current liabilities include:

-

- Accounts Payable: Money owed to suppliers for goods and services received, accounts payable reflect short-term debts.

-

- Short-Term Debt: Loans to be repaid within a year, short-term debt involves borrowed funds with an imminent deadline.

-

- Accrued Liabilities: Expenses incurred but not yet settled, accrued liabilities include pending payments like wages or taxes.

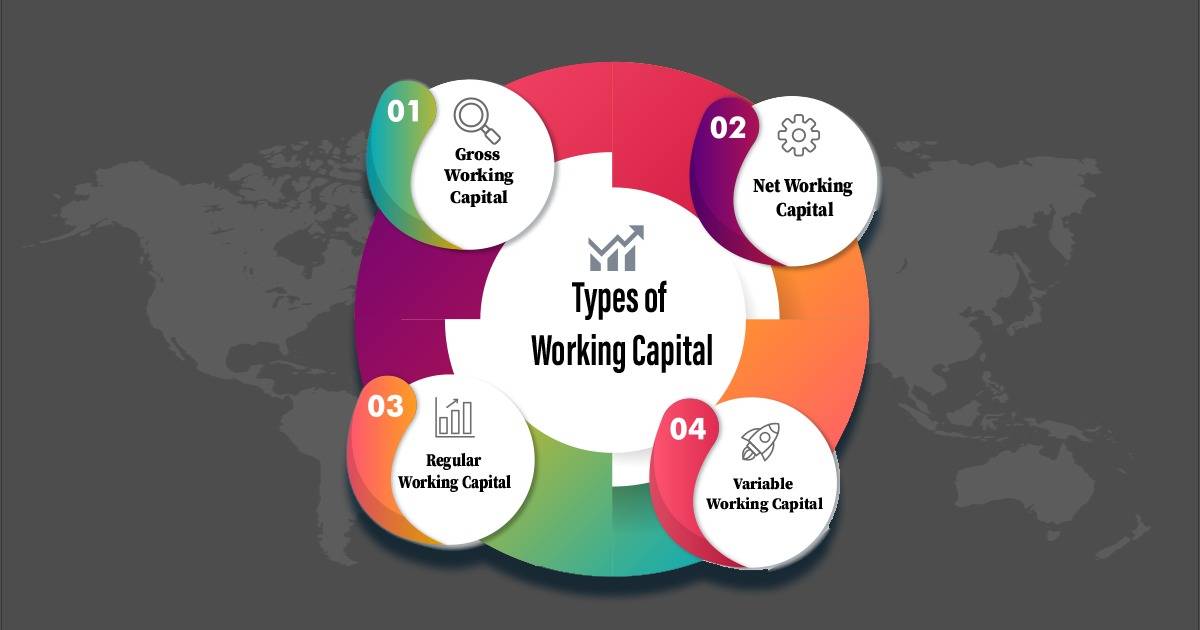

Types of Working Capital

Working capital, often seen as the financial life force of businesses, comes in a variety of forms, each serving a specific purpose. Here, we’ll break down four types of working capital to give you a clearer understanding of their roles and importance.

1. Gross Working Capital: The Total Financial Arsenal

A business’s current assets are the money and valuable things it has right now. Gross working capital is the grand total of these assets, including cash, money owed by others, goods to be sold, and even expenses paid in advance. It’s like seeing the complete financial landscape at a glance.

2. Net Working Capital: The Balancing Act

Net working capital is all about finding the balance between what a business owns and what it owes. If the business has more money and valuable stuff then it owes a positive net working capital indicating a sign of stability. If it owes more than it has, it’s a negative net working capital, which raises a caution flag.

3. Regular Working Capital: Fueling Everyday Operations

Picture regular working capital as the financial fuel that keeps a business running smoothly on a daily basis. It’s like the money in your pocket that you use for your day-to-day needs. By removing less essential items from the total, this type of working capital focuses on the essential resources required for ongoing operations.

4. Variable Working Capital: Flexibility in Finances

n a business’s journey, there are times when it needs more financial firepower due to increased activity. Variable working capital is like an extra reservoir of money reserved for such dynamic situations. It’s the difference between the constant financial resources a business has and the adaptable ones it needs when circumstances change.

Impact of Negative Working Capital

Negative working capital arises when a company’s short-term debts surpass its immediate assets, bringing several challenges. It can strain cash flow, causing difficulties in meeting financial obligations on time, and leading to penalties and strained relationships. This limited liquidity can curtail investments in growth initiatives, hindering expansion and development. Operations can also be disrupted due to cash shortages, impacting day-to-day functions and customer satisfaction. Borrowing becomes tougher, and late payments to suppliers can strain partnerships and supply chains. Furthermore, missed market opportunities due to financial inflexibility can occur.

To address these issues, effective cash flow management is vital, optimizing payment schedules and receivables. Streamlining operations by reducing inefficiencies, tightening credit policies, and exploring short-term financing options are essential steps. By focusing on these strategies, businesses can mitigate the challenges posed by negative working capital, stabilizing their financial health, and enabling growth opportunities.

Summary

As we conclude our comprehensive exploration of working capital, it’s evident that this financial metric is far more than a technical term. It’s the heartbeat of business operations, a compass for financial health, and a key determinant of growth potential. Working capital isn’t just about numbers; it’s the foundation that keeps businesses afloat, ensuring bills are paid, opportunities are seized, and resilience is maintained.

Whether you’re a seasoned entrepreneur or a novice, the mastery of working capital can guide your decisions and actions toward success. In your journey toward financial empowerment, may the insights shared by Prudent Capital serve as a guiding light, empowering you to optimize working capital, foster stability, and propel your business toward prosperity.

Add a Comment